What Is an IRA and How Do They Work

What is an IRA?

An IRA is short for Individual Retirement Account. Congress created IRAs in 1974 to provide an investment vehicle to help individuals better save for retirement in a tax advantaged way. You can use these accounts to invest in mutual funds, ETFs, stocks, bonds or other investment vehicles.

Who can contribute to an IRA?

- Anyone with earned income.

- A spouse of anyone with earned income.

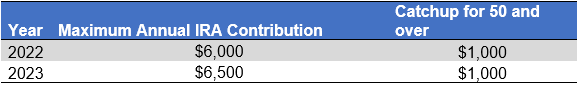

Annual Contribution Limits 2022-2023

- Anyone eligible for an IRA may contribute up to 100% of your annual earned income or the IRS’s maximum annual contribution limit (whichever amount is less).

Annual IRA and Roth IRA Contribution Limits

How does an IRA work:

How an IRA account works depend on if you have a workplace account.

- No workplace retirement plan:

If you do not have a workplace retirement plan -

You would make tax deductible contributions to your IRA.The money in the account accrues tax deferred for the life of the account. Income taxes are only paid when the money is withdrawn.

- With a workplace retirement plan:

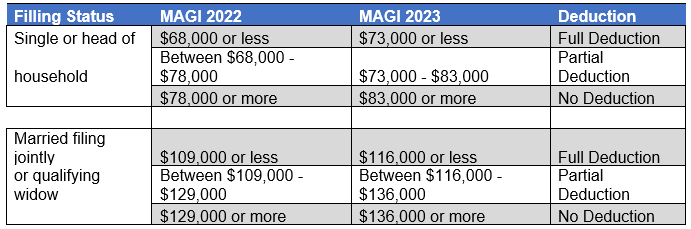

If you have a workplace retirement account - there are income limits to determine if your initial contribution would be eligible for a tax deduction. For 2023, if you are single and your income is less than $73,000 or married and your joint income is less than $116,000, you are eligible for a tax deduction. Beyond that amount, the tax deduction phases out, see chart.

Deductibility of an IRA for participants of an employer sponsored plan.

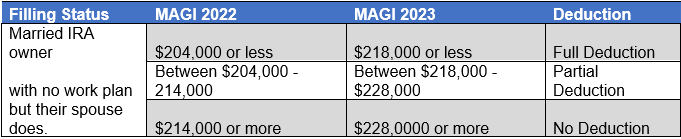

Deductibility for a married IRA owner with no work plan but their spouse does

When can you contribute?

You can make IRA contributions from January 1st until the tax date of the following year which is typically April 15th. For a 2022 contribution, the last day to make a contribution is April 18, 2023.

When can the money be withdrawn?

Money from your IRA can be withdrawn penalty free starting at age 59.5. Once removed, you would owe income tax on your withdrawal.

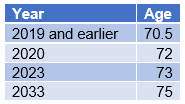

What is an RMD and how do they work?

RMD’s or Required Minimum distributions. Once you reach a certain age, you are required to take Required Minimum Distributions from your IRA. For 2023, that age is 73 years old. The annual amount you are required to withdraw is based on the value of your account on January 1st and your life expectancy.

RMD Age Changes

-

Click here for a list of exceptions.

-

Exceptions to 10% penalty for early withdrawal

There are certain situations that allow you withdraw money from your IRA without the 10% penalty which are listed below. You would still be required to pay income tax on the withdrawals.

- Medical expenses – the exemption applies if you incur medical costs that exceed 7.5 of your adjusted gross income.

- Health insurance – unemployment status & received 12 weeks of unemployment checks. Allowance to take distribution to pay medical insurance premiums.

- Permanent Disability – required to provide medical documentation.

- First time home purchase

- Single status - $10,000 – allowable withdrawal – no penalty

- Married status - $20,000 – allowable withdrawal – no penalty.

- Inherited IRA – from parent or spouse before age 59.5, penalty-free distribution. If non-spouse beneficiary (died after 2020), required distribution within 10 years.

- IRS – if you owe federal taxes.

- SEPP – Substantially Equal Periodic Payment – if approved, receive annual payment for 5 years. To qualify, 3 IRS methods are amortization, annuitization, and required minimum distribution.

If you have any questions regarding IRA’s or other investment and financial planning questions do not hesitate to contact our office. Lowell Road Asset Management works with individuals and families with financial planning and asset management.