A logical, repeatable approach to investing.

At LR we follow a repeatable strategy for successful long term investing. We believe the three keys to being a successful investor include studying financial history, being properly diversified and making adjustments based on valuation.

1. History

By studying the history of various financial markets clients can get a strong understanding as to what to expect. What have historical returns been for various asset classes, sectors and geographies. How volatile are each of those asset classes. How often have certain markets corrected and how deep have those corrections been. We use this history data along with each client’s goals, objectives, risk tolerance and time frames to develop an investment portfolio to help clients meet financial goals.

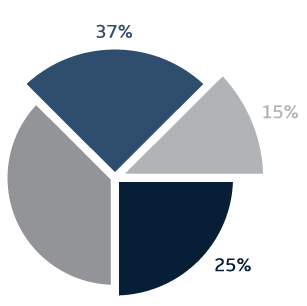

2. Diversification

Why diversify? The goal of properly diversifying a portfolio is to reduce risk, reduce volatility and in many cases improve the performance of client’s accounts. Ideally this will smooth out client performance and make it more comfortable for clients to with stand inevitable market corrections. The holy grail of investing is have multiple quality investments with as little correlation as possible.

3. Valuation

Rebalancing, reversion to the mean, the less you pay typically the more you make. The objective of rebalancing a portfolio is to be taking profits from what has become expensive and reinvesting in what is less expensive.